tax lien attorney nj

Contact Our New Jersey Tax Attorneys. Feel free to contact me.

Federal Tax Liens Due Process Hearings Nj Tax Attorney

A Certificate of Debt has the same force and effect as a Docketed Judgment adjudicated in any court of law.

. Liens are typically used to secure payment of a debt eg loans. Ad Settle Tax Debts up to 90 Less. Since the amount that the bidder must pay for the lien is fixed.

As the tax lawyer New Jersey clients trust to resolve civil and criminal tax disputes he has experience working with a wide range of complicated tax cases. Tax Lawyer Serving New Jersey. The New Jersey Estate Tax is a lien on all property of a decedent as of their date of death.

My brother is behind in his taxes but the house is - Answered by a verified Real Estate. Suite 400 Morristown NJ 07960. 18 per annum Bid Method.

NJ Tax Lawyer and NJ Tax Law firm provides a wide spectrum of tax preparation. Moorestown NJ Tax Law Lawyer with 42 years of experience. We Have Resolved Over 1 Billion Dollars in Tax Debts for Our Clients.

Money Back Guarantee - Free Consultation. Just because a seminar or tape makes tax liens sound like a sure thing does not mean it is a smart move for you. Other Tax Attorneys Charge For Tax Advice We Give It Free.

Compare the best Tax Lien lawyers near Paterson NJ today. End Your IRS Tax Problems. A lien gives its holder.

Tax Liens Interest Rate. Ad Find solutions to difficult debt problems. Based On Circumstances You May Already Qualify For Tax Relief.

As a tax and business attorney for more than 25 years I have helped. 2 Years Sale Dates. Can a lawyer help with my real.

We Have Resolved Over 1 Billion Dollars in Tax Debts for Our Clients. Litigation over railroad tax exemptions from local property taxes. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

Honest Trusted Reliable Tax Services. Whether you need assistance. Search for legal issues.

Use FindLaw to hire a local tax lawyer near you. Find an Attorney. Find an Attorney.

100 Money Back Guarantee. Trusted New Jersey Tax Lien Defense Attorney Successfully Handles Cases For Clients In Camden County Burlington County Gloucester County And Throughout South Jersey. A lien in Jersey City New Jersey is a property right that a person or entity has in property owned by someone else created by law for the purpose of enforcing a debt.

Contact our East Brunswick law office to learn more about our debt relief services. Ad Honest Fast Help - A BBB Rated. Free Tax Analysis Options.

Up to 15 cash back I need help understanding how a tax lien works in New Jersey. Ad As Heard on CNN. Compare the best Tax Lien in New Jersey.

Tax lawyers can assist with understanding tax law and resolve tax liens back taxes tax debt recovery and relief and IRS compliance issues. Tax Liens Tax Appeal IRS Levy Release---Lawyer offices are located in Morris County of Northern New Jersey 55 Madison Ave. Free Case Review Begin Online.

A Rated in BBB. The tax applies to all decedents who died after December 31 2001 but before. Do You Qualify For The Fresh Start Program.

Search Legal Resources. Money Back Guarantee - Free Consultation. Call now for a free consultation.

To learn more about what McLaughlin Nardis New Jersey tax attorneys can do to. Ad Settle IRS New Jersey Tax Problems. Help With Tax Collections Unfiled Taxes Unpaid Taxes Penalties Levies Liens More.

Get Free Consult Now. Learn about Property tax liens on New Jersey today. A tax lien is a special type of lien that is filed by the government against the assets of an individual or entity.

Use our free directory to instantly connect with verified Tax Lien attorneys. Use our free directory to instantly connect with verified Tax Lien attorneys. During this 2-year period and during the foreclosure case the investor must pay all the property taxes assessed by the.

Ad As Heard on CNN. In New Jersey the waiting period is two 2 years for private investors. Certificates of Debt are the primary vehicle for our collection process.

Quickly find answers to your Property tax liens questions with the help of a local lawyer. End Your Tax Nightmare Now. Ad See If You Qualify For IRS Fresh Start Program.

BIDDING DOWN TAX LIENS Bidding for tax liens under the New Jersey Tax follows a procedure known as bidding down the lien. New Jersey Tax Liens Sale Type. End Your IRS Tax Problems.

Bid down the interest or premium Redemption Period. Ad 5 Best Tax Relief Companies of 2022. Search Legal Resources.

Ad Top BBB Ethics Award Winner 2019.

Attorney Bruce Levitt Wins A Lawsuit And Helps A Family Get Back Their Home Lost To A Tax Lien Foreclosure Levitt Slafkes P C

How To Fight An Invalid Lien On Your Property

How To File A Mechanics Lien A Step By Step Guide Levelset

Attorney Charing Liens In New Jersey The Business Divorce Law Report August 12 2019

Mandelbaum Barrett Mandelbaumlaw Twitter

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

How Do I Know If There S A Lien On My Property Howstuffworks

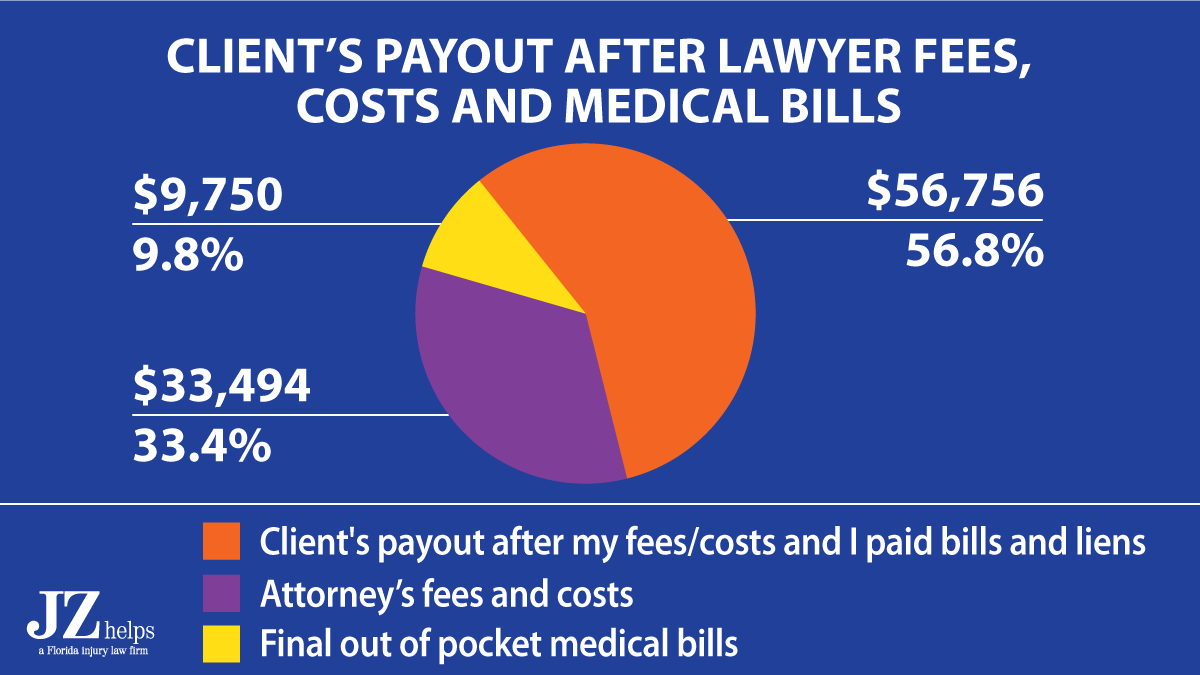

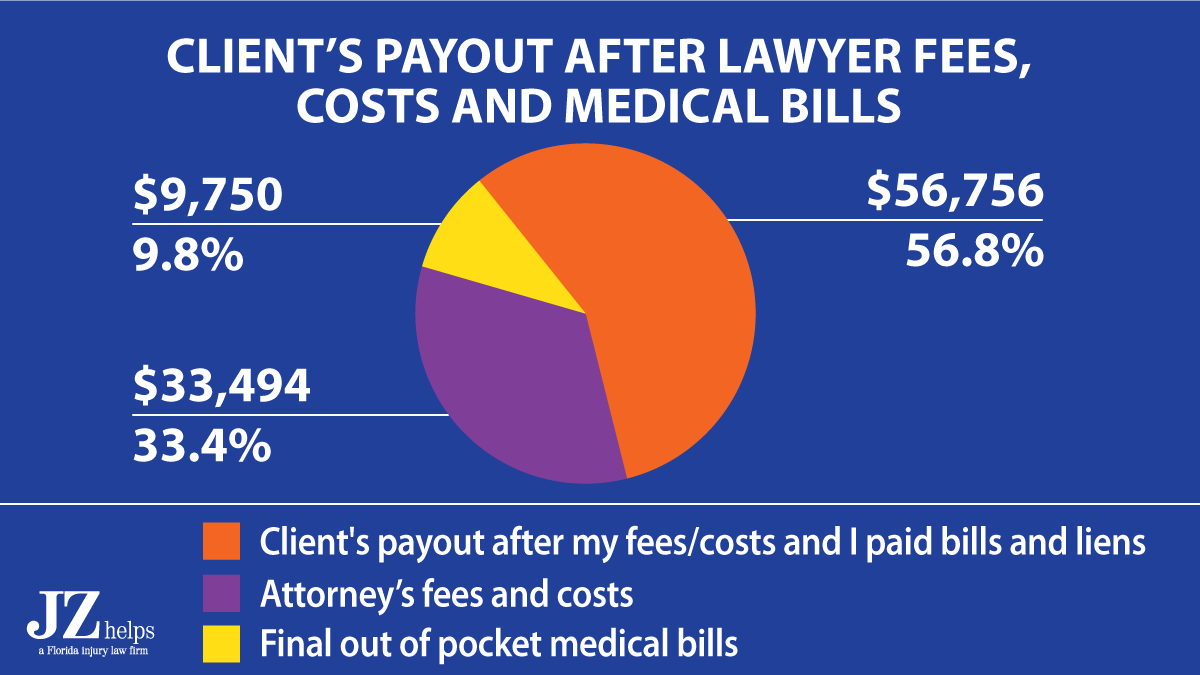

Stop The Pirates Personal Injury Law Personal Injury Lawyer Injury Lawyer

Bruce Levitt Wins Tax Lien Foreclosure Appeal Levitt Slafkes Levitt Slafkes P C

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

Witness Says He Rigged Bids In Property Tax Lien Auctions In Maryland Center For Public Integrity

Investing In Tax Liens With A Llc Or Corporation Youtube

Pain And Suffering Settlement Examples Car Accidents And More 2022

:max_bytes(150000):strip_icc()/InformedInvestor1-ad8820ed535f4d1184e2805f5cb60895.jpg)

Best Tax Lien Investing Courses Of 2022

How To File A Lien 14 Steps With Pictures Wikihow

Attorney Charing Liens In New Jersey The Business Divorce Law Report August 12 2019

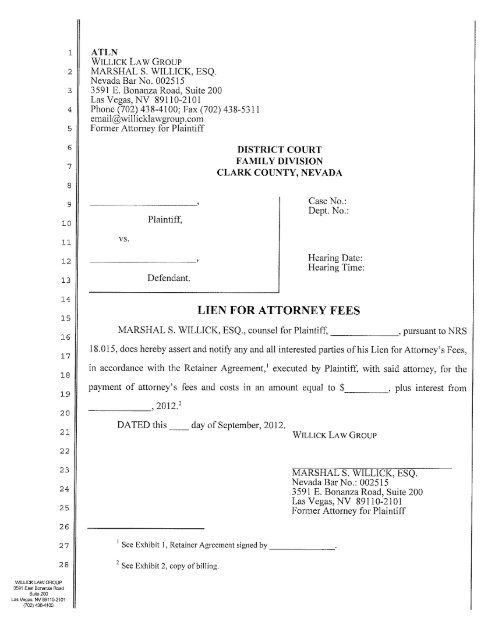

Sample Lien For Attorney Fees Motion To Willick Law Group

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

New Jersey Mechanics Liens Everything You Need To Know Free Forms